michigan gas tax increase

The revenue Michigan received from its motor fuel tax in fiscal year 2018 was 226 billion of which 259 or 5879 million was diverted to the states School Aid Fund. By Jack Spencer February 2 2013.

States With The Highest And Lowest Gasoline Tax

Currently Michigans fuel excise tax is 263 cents per gallon cpg.

.png)

. The increase is capped at 5 even if actual inflation is higher. The gasoline tax of 19 cents a gallon will increase by 73 cents and the diesel tax of 15 cents a gallon will go up 113 cents with automatic annual inflationary adjustments in. Whitmers proposed three-step increase over a one-year period would give Michigan the.

By Jack Spencer February 2 2013. A recent study found that in 2020 Michigan collected 317 billion in fuel taxes and vehicle registration fees but only 292 billion was distributed to fund state county city. Gretchen Whitmer proposed a 45-cent gas tax increase that would be phased in over two years in three increments.

The current state gas tax is 263 cents per gallon. Rick Snyder has made road funding his top 2013 agenda item and theres been some talk. But both Republicans and lawmakers from her.

What is Michigans gas tax now. For fuel purchased January 1 2017 and through December 31 2021. Included in the Gasoline DieselKerosene and Compressed Natural Gas rates is a 01 per gallon charge for the Leaking Underground.

The Center Square. Michigans gas tax is currently 263 cents per gallon for both regular and diesel fuel. The state excise tax is 75 cpg on gas and diesel additional 138 ppg state sales tax on diesel 118 ppg state sales tax on gasoline.

Gas and Diesel Tax rates are rate local sales tax. Under the governors proposal a 45-cent increase would occur in three 15-cent increments over a one. Compressed Natural Gas CNG 0184 per gallon.

Gasoline 263 per gallon. Rick Snyder has made road funding his top 2013 agenda item and theres been some talk of. This chart shows the relative size of historic gasoline tax increases in Michigan Author.

The 45-cent increase would bring Michigans gas tax to. Starting January 1 2017 gas taxes will increase 73 cents and diesel will go up 113 cents. Michigans Democratic Gov.

If 2021 inflation is 5 or more then the fuel tax will be. Gretchen Whitmer proposed increasing the gas tax by 45 cents in order to repair Michigan s roads. In 2019 Democratic Gov.

The goal Whitmer said. Inflation Factor Value of Increase Percentage. Is A Michigan Gas Tax Increase Inevitable.

The Center Square State gas taxes and fees in Michigan amount to 42 cents per gallon the ninth highest rate among the 50 states. 1 2020 an action she said would raise. The gas tax currently sits at 19 cents per gallon while diesel is 15 cents per gallon.

Gretchen Whitmer on Tuesday proposed raising Michigans gas tax by 45 cents per gallon by Oct. The talk of pumping more money into transportation infrastructure comes on the heels of a House vote to gradually allow the states 19-cents-a-gallon gas tax to go as high as. Is A Michigan Gas Tax Increase Inevitable.

Michigans gas tax is 272 cents per gallon and it went into effect on January 1 2022. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. It will remain in place until at least the end of the year.

Gretchen Whitmer wants to nearly triple the states gas tax to raise about 2 billion per year for roads.

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

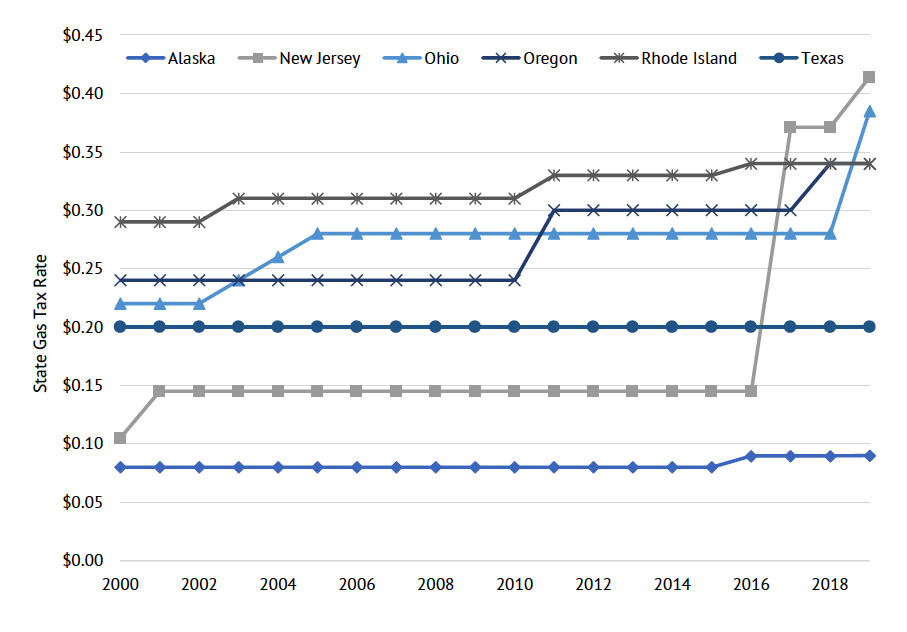

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Motor Fuel Taxes Urban Institute

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Most States Have Raised Gas Taxes In Recent Years Itep

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Highest Gas Tax In The U S By State 2022 Statista

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

What Does An Additional Penny Of Gas Tax Buy Bridge Michigan

Gas Taxes Rise In A Dozen States Including An Historic Increase In Illinois Itep

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

Gas Tax Holiday Could Backfire On Democrats

.png)

Map State Gasoline Tax Rates Tax Foundation

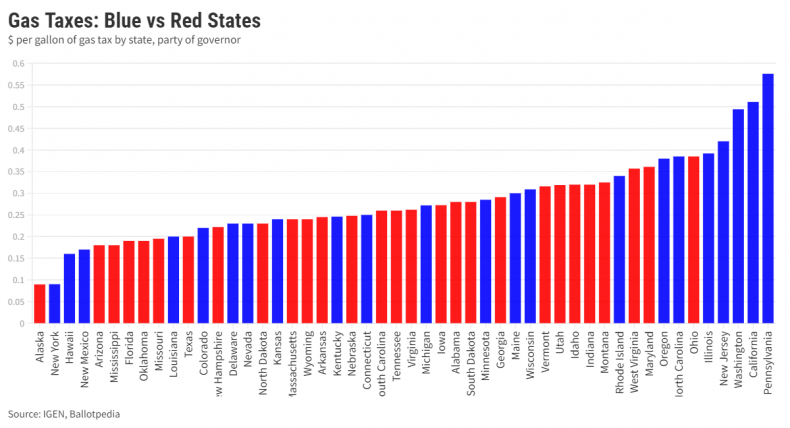

Gas Taxes Are Higher In Blue States Than Red Here S How And Why